via: Richard_Mills

ahead of the Herd has been digging into why important banks are purchasing lots of gold lately . What we've found is eyebrow-raising, to assert the least. It may be the most appropriate reason you've ever study for desperate to buy gold.

ahead of the Herd has been digging into why important banks are purchasing lots of gold lately . What we've found is eyebrow-raising, to assert the least. It may be the most appropriate reason you've ever study for desperate to buy gold.

Take this headline from the Northern Miner: "Editorial: primary banks are major gold buyers in 2019". Citing data from the world Gold Council, the Northern Miner studies that principal banks netted fifty one tonnes in gold purchases, essentially the most in view that October 2018, after they increased gold held in crucial financial institution vaults via a hundred and five tonnes. Switching to ounces, the Miner states that gold holdings grew by a startling 2.9 million oz. in January and February 2019, versus 1.9 Moz during the equal period of 2018. this is the highest level of gold purchasing by central banks considering that the primary two months of 2008 - during the economic disaster.

significant banks backed up the truck for gold in 2018, buying 651.5 tonnes versus 375 tonnes in 2017. That's the greatest web purchase of gold given that 1967.

The Miner means that anti-US sentiment is at the root of all this crucial bank gold purchasing. "And sure, there is a distinct geopolitical point to it all, as these relevant financial institution consumers are predominantly from countries that stand in direct economic or political opposition to the U.S., and so are keen to movement far from the U.S. dollar as a overseas reserve foreign money."

Case in point: the exact two valued clientele have been Russia and Turkey.

Russia is actively searching for to in the reduction of its dependence on the greenback to be able to skirt US sanctions for, among different issues, interfering within the US presidential election and invading Crimea. The Kremlin stopped purchasing overseas foreign money in September 2018 to prevent the ruble from crashing due to sanctions. instead the Russian important financial institution grew to become to gold, buying a checklist 274.3 tonnes in 2018, in accordance with BNE Intellinews, while selling a whack of US Treasuries - bringing its share of the U.S. dollar as a foreign reserve down from forty three.7% to 20%. Between March and can of closing yr, Russia offered off 84% of its US debt holdings, leaving just $14.9 billion in its US reserve account.

Turkey wants gold to offer protection to itself against a gradual financial system (over the past yr the lira has lost 30% of its value making it problematic for patrons to buy imported items). Gold-buying is a technique to aid the lira versus buying US Treasuries, which is complex to do with the relative electricity of the USA dollar. a couple of years in the past Turkey's President Erdogan referred to as on residents to purchase gold, and they have: "those that retain dollar or Euro currency beneath their mattresses should come and turn them into Liras or gold."

Goldcore summarizes the situation in Turkey viz a viz gold:

the rush for guide for gold is 2-fold, first it is an try and boost have faith in the central banking gadget which is in increasingly dire straights, the 2d is to help the underlying foreign money which is important to the 'axis of gold' (h/t Jim Rickards) it really is Russia, China, Turkey and Iran. both of those issues push again towards US greenback hegemony.

And there we've it. The reason behind principal banks' contemporary gold accumulations has little to do with secure havens and an awful lot to do with chipping away at the US dollar's role as the reserve currency. this text will clarify what's occurring.

rise of the petrodollar

In July 1944, as Allied troops were racing throughout Normandy to liberate Paris, delegates from forty four nations met at Bretton Woods, New Hampshire and agreed to "peg" their currencies to the USA greenback, the only foreign money robust enough to fulfill the rising calls for for foreign forex transactions.

What made the dollar so appealing to make use of as a world forex, the world's reserve forex, become each US dollar become based on 1/thirty fifth of an oz. of gold (35.20 US greenbacks an oz), and the gold was to be held within the US.

the united states begun to ship higher and larger quantities of bucks distant places to fund their increasing trade deficits.

The glut of US greenbacks held overseas begun to threaten US gold reserves – bear in mind US dollars have been redeemable for gold – and worldwide demand for gold was hovering. through the late 1950's US gold reserves had began to dwindle swiftly.

With the Gulf of Tonkin incident in late 1964 and the acceleration of the Vietnam warfare in 1965, US military spending exploded. This changed into compounded by President Lyndon B. Johnson's exquisite Society challenge spending and not raising taxes.

due to the fact Johnson refused to raise taxes to pay for the social welfare reforms undertaken previous and the battle in Vietnam, the U.S. changed into now operating big stability of payment deficits with the world.

In October of 1960 panic purchasing brought about gold's rate to rise to over US$forty per oz. a night-time emergency name changed into made through the united states Federal Reserve. The financial institution of England became to instantly flood the gold market with ample provide to cut back and stabilize the price of gold. the U.S. had simply made it abundantly clear that stopping the drain of its gold reserves, and the depreciation of its forex in opposition t gold, become a big priority.

the USA, the bank of England and the principal banks of West Germany, France, Switzerland, Italy, Belgium, the Netherlands, and Luxembourg then deploy a gold income consortium to stay away from the market fee of gold rising above US$35.20 per oz. This consortium turned into accepted because the London Gold Pool. This intended that the greenback would now be backed now not best by using the gold in fort Knox however the entire different pool individuals' gold as smartly.

regardless of the Cuban Missile disaster and escalating tensions between Moscow and the USA, gold prices remained fairly reliable; the London Gold Pool become successful.

With the Gulf of Tonkin incident in late 1964 and the acceleration of the Vietnam war in 1965, US armed forces spending exploded. in view that US President Johnson refused to carry taxes to pay social welfare reforms and the struggle in Vietnam, the U.S. became now working large balance of funds deficits with the world.

Gold demand skyrocketed.

a couple of planeloads of gold have been emergency airlifted from the us to London. Gold demand persevered to boost with the London Gold Pool selling a hundred seventy five tons at some point and the very subsequent day promoting an extra 225 lots. This broke the returned of the London Gold Pool. participants have been uninterested in draining their international locations' gold reserves to pay for the USA's Vietnam war and social reform policies.

An reputable "two-tiered" rate for gold changed into introduced to the world - the authentic fee of US$35.20 would remain for relevant banks dealings, the free market may locate its personal cost.

In February 1970 the closing gold expense on the London market averaged US$34.ninety nine. On August 15, 1971, US President Nixon ended the convertibility of the dollar into gold. With gold at last demonetized, the Fed and the area's significant banks had been now free from having to look after their gold reserves and a hard and fast greenback cost of gold. The period of Bretton Woods turned into over.

For more financial history, read our demise of London Gold Pool ends Vietnam struggle

Recognizing that the us, and the leisure of the area changed into going to make use of lots of oil, and that Saudi Arabia wanted to promote the realm's largest economy (via far the united states) that oil, Nixon and Saudi Arabia came to an contract in 1973 whereby Saudi oil may simplest be purchased in US dollars. This brought about a right away and strong international demand for the buck.

by means of 1975 all OPEC participants had agreed to sell their oil simplest in US greenbacks - for this reason ushering in the period of US "petrodollar" dominance that continues to at the present time.

Exorbitant privilege

within the Nineteen Sixties French flesh presser Valéry d'Estaing complained that the U.S. and its exporters loved an "exorbitant privilege" due to the dollar's fame because the world's reserve forex. He had a degree. because the greenback changed into, and is, the realm's forex, the us can borrow extra cheaply than it may otherwise (lower hobby rates), US banks and agencies can quite simply do pass-border company the use of their personal currency, and when there is geopolitical anxiety on the planet, critical banks and buyers purchase US Treasuries, holding the dollar high and the USA insulated from the battle. A government that borrows in a foreign foreign money can go bankrupt; no longer so when it borrows from overseas in its own forex.

The greenback is essentially the most important unit of account for foreign change, the leading medium of change for settling international transactions, and the save of value for primary banks. The Federal Reserve is the lender of last resort, as in the 2008-09 monetary disaster, and is the most regular foreign money for overseas borrowing by way of governments and corporations.

Wall street generates huge earnings from selling banking functions in USD to the rest of the world, and the U.S. manages the area's most essential agreement systems, allowing it to video display and restrict funds used for illegal actions.

US$ losing its privilege

Barry Eichengreen, creator of "Exorbitant Privilege: the upward push and Fall of the greenback and the future of the international economic equipment," names three entertaining attributes to the dollar that no other foreign money has: dimension, balance and liquidity.

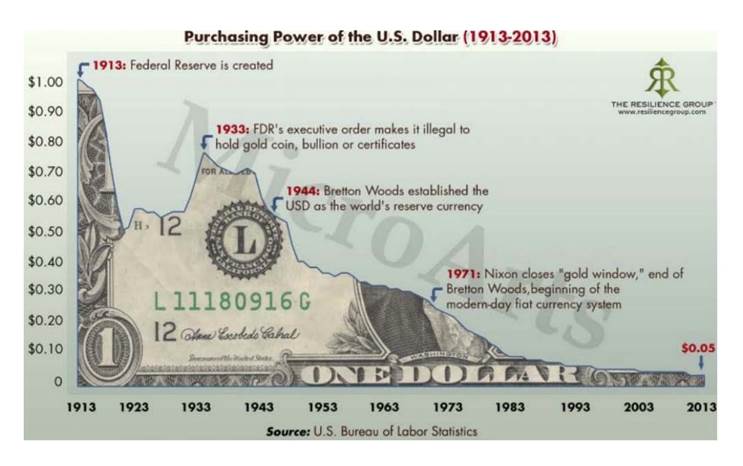

whereas the attendees at the Bretton Woods convention in 1944 estimated the USD having fun with these advantages in perpetuity, the reality is the dollar has been in decline for some time. seeing that the Federal Reserve was created in 1913, the dollar has lost 95% of its cost. (see graph under). Over one hundred years ago a buck became price a buck; in 2013 it turned into valued at 5 cents – its worth eroded via inflation.

Then there's the USA debt, at present sitting at over $22 trillion and growing to be day by day.

Jeffrey Sachs, writing for assignment Syndicate, argues "the dollar punches a ways above america's weight on this planet economic climate," producing just 22% of world output, but accounting for 50% or more of pass-border invoicing, reserves, settlements, liquidity and funding. as a result of US fiscal and financial mismanagement, as described above, the Bretton Woods monetary device install in 1944 collapsed. The breakdown of a gold-backed greenback resulted in excessive inflation within the US and Europe, then a fall in inflation within the early Nineteen Eighties.

Sachs argues the turmoil of the dollar turned into a key element in motivating Europe to embark on monetary union, ensuing within the euro's launch in 1999. equal with the us's mishandling of the 1997 Asian debt disaster which resulted in China desperate to internationalize the renminbi, or chinese yuan.

The 2008-09 monetary disaster which began in the US throughout the sub-leading personal loan debacle, turned into an additional flag to the relaxation of the world signaling a stream away from the dollar towards different currencies, notes Sachs. "the united states's economic stewardship has stumbled badly over the years, and Trump's misrule may hasten the conclusion of the greenback's predominance."

The quantitative easing program that noticed the Fed's belongings skyrocket from $900 billion to $four.5 trillion between 2019 and 2015 (in the course of the purchasing up of Treasuries, paid for via printing cash), made it not pricey for the U.S. govt to continue to borrow and spend - with charges close to zero.

besides the fact that children, QE additionally showed other international locations that now not become the united states following a sound fiscal policy; all it was doing become printing funds. nations began to diversify their overseas alternate reserves and cut back their dependence on the dollar. in accordance with the IMF, USD international exchange reserves have dropped from 72% of the realm's foreign exchange in 2001 to 62% nowadays. 7

Saudi Arabia's 'nuclear' alternative

The fee of crude oil and gas have surged considering the fact that January, causing alarm within the Trump Administration. The commander-in-chief has been sending irritated tweets directed at OPEC, blaming the oil cartel for top fuel prices. indeed, gasoline expenditures have risen about 50 cents a gallon during the last ninety days, per elevated crude fees, which on Wednesday closed at $63.fifty eight a barrel (WTI) from $48. 452/barrel on Jan. 7.

It wasn't lengthy ago that everybody become complaining about oil fees being too low!

In response, the condo Judiciary Committee passed a bill allowing the U.S. to sue contributors of OPEC for manipulating the oil market. The so-known as "NOPEC" bill has been proposed below past administrations, but no outdated presidents have dared to threaten the USA-Saudi relationship.

Trump in typical cavalier trend is the first to achieve this. He thumbed his nostril on the Arab world by recognizing Jerusalem as the capital of Israel and Israeli sovereignty over the Golan Heights.

The unconventional president has picked on the threads of the us-Saudi relationship, leading to its unraveling. As a presidential candidate, Trump referred to as the Saudi regime the realm's biggest funder of terrorism.

To be reasonable, Saudi Arabia's Crown Prince, Mohammed bin Salman (MBS), has shown a disturbing recklessness in overseas coverage - from the bloody Yemen conflict, to the blockade of Qatar, the kidnapping of the Lebanese leading minister, and the near-give way of the Gulf Cooperation Council.

The low aspect came when the U.S. didn't shield MBS amid common condemnation over what appeared to be a premeditated killing of a Saudi journalist, Jamal Khashoggi.

there's additionally situation over the construction of Saudi Arabia's first nuclear reactor and whether its nuclear ability can be put to use making weapons. while both reactors are intended for energy creation, MBS mentioned final year that the dominion would increase nuclear palms if Iran did so.

recently the united states Congress handed a bill removing help for the Saudi struggle in Yemen - onerous any goodwill left between the two countries.

lower back to the NOPEC bill, the circulate to expose OPEC individuals to US antitrust proceedings put Saudi Arabia on the protecting. The oil-soaked nation is threatening to kill the petrodollar if the U.S. moves forward on the legislation, via selling its oil in non-greenback currencies.

Oilprice.com studies the results of OPEC contributors rejecting dollar dominance in oil earnings could be extraordinarily dangerous for the U.S. financial system. here's the so-called "nuclear" option:

The international oil market is practically completely performed in greenbacks, which offers the groundwork for dollar domination in the world economic system. Introducing new currencies within the oil alternate could undercut demand for the dollar, shrink American have an impact on over world finance, weaken American influence over sanctions, and as a result, undercut its geopolitical attain. It's hard to determine how severe Saudi Arabia is, but the implications of this kind of move are some distance-reaching and difficult to overstate.

The willing beneficiaries of oil traded in aside from US greenbacks, consist of China, Russia and the european Union, all of which have expressed frustration at the Trump Administration's medicine of other international locations, and known as for a resetting of the greenback-based mostly foreign device.

China and Russia have inked power deals whereby exchange is carried out in rubles and yuan; China has additionally begun a yuan-denominated oil futures contract, based in Shanghai.

and maybe most significantly, in a huge snub to the us, Iran and the european agreed to deploy a new funds device to permit exchange with Iran, as a way to prevent US sanctions coming up from the scrapping of the 2015 Iran nuclear deal. (Trump mentioned in may also 2018 that "any nation that helps Iran in its quest for nuclear weapons may be strongly sanctioned"). The "special aim car" is with ease the eu's personal SWIFT, the Society for international Interbank fiscal Telecommunications used for transferring cash between international locations - which conducts transactions in USD.

perfect storm for gold

Amid rising regional tensions that has Saudi Arabia, the realm's biggest oil exporter, looking past its particular relationship with the U.S., and wider geopolitical traces between the U.S., China and Russia (suppose in regards to the US-China change struggle, naval posturing within the South China Sea, Russia supporting outcast Venezuelan President Maduro in what has traditionally been the USA's backyard), we now have greater evidence to reveal that the vaunted USD is beneath risk.

Consideration of an alternative, loony-left economic idea that should have been dismissed outright by means of American lawmakers is truly being taken critically, because of the untenable place the united states finds itself in involving its mounting pile of debt.

up to date economic concept posits that as opposed to obsessing about how significant the debt has grown (over $2 trillion) and the continuing annual deficits that gas debt, govt should still target certain spending courses for you to cause minimal inflation.

Curb inflation and the debt can retain growing, with out a penalties. here's since the US executive can not ever run out of money. It simply maintains printing money, as a result of bucks are all the time famous (with the greenback being the reserve foreign money, and commodities are traded in bucks).

government is for this reason given a free pass on spending, since the handiest factor that we have to agonize about with the national debt is inflation.

Fiscal policy on steroids is, in response to its proponents, to be the new engine of US growth and prosperity.

besides the fact that MMT isn't adopted, and it's extraordinarily unlikely that it will be, simply the theory of the U.S. dollar dropping its position because the world's reserve foreign money is alarming.

If it took place all at once, a large sell-off of US Treasuries would effect, crashing the cost of the dollar. it will make the economic crisis of 2008-09 seem like a mere inventory market correction.

recall the frenzy of relevant financial institution gold purchasing described at the proper. nations preserving gigantic quantities of US Treasury bills have to be concerned concerning the capacity of the U.S. to maintain financing its debt. If OPEC kills the petrodollar, its price could halve overnight. And if the debt burden turn into so hard that lawmakers make a decision to are attempting MMT, the dollar would take a massive hit.

In light of these hazards, is it any ask yourself significant banks are bulking up on bullion?

certainly, gold's status as save of value, as cash, the best foreign money accessible when yours is nugatory, has come into play with admire to the drama that has been unfolding in Venezuela over the remaining couple of years.

Gold gives everyone some thing that fiat currencies (paper cash), or every other monetary innovation, can not carry. Gold is insurance, irreplaceable in its capabilities.

Wall road became its returned on gold since it can't produce boom "sprouts", but overseas banking guidelines lately changed to accommodate the yellow steel.

under the historical Basel I and II guidelines, gold turned into rated a Tier 3 asset. beneath Basel III Tier 3 has been abolished, making gold bullion a Tier 1 asset, as of March 29. Tier 1 capital is the measure of a financial institution's monetary electricity, from a regulator's factor of view. additionally, and here is crucial, under Basel III a financial institution's Tier 1 belongings should upward push from the current four% of total belongings to six%.

as a result of gold is now a Tier 1 asset, banks can function with far less capital than is invariably required. Gold is the brand new backstop for debt, currencies and bank fairness capital.

significant banks obviously see the price of retaining gold over paper assets; after 2008, mortgage-backed securities (MBS) lost most of their value and that they have additionally suffered large value destruction by way of conserving sovereign securities ie. Greece and Italys, that are nowadays, also close nugatory). possibly practically a doubling of gold bullion purchases in 2018 over 2017 shows that vital banks believe gold is a stronger Tier I asset than govt debt and MBS? there is also that 2% increase in total assets to 6%, which now needs to be stuffed, doubtless by way of gold.

In a further method notwithstanding, crucial financial institution gold buying is undermining the dollar. It's sending a sign to the us government, and the Federal Reserve, that the buck is no longer as essential because it once become. It's not risk-free, and the U.S. isn't any longer considered to be the most powerful nation on the earth, carrying the greatest stick and the fattest wallet.

What could be the longer term world foreign money? The yuan? Euro? A basket of currencies aka "special drawing rights" SDR deploy in the course of the IMF? the place will gold slot in a new currency association?

through Richard (Rick) Mills

if you are drawn to studying greater about the junior aid and bio-med sectors please come and talk over with us at www.aheadoftheherd.comsite membership is free. No bank card or personal assistance is asked for.

Richard is host of Aheadoftheherd.com and invests within the junior useful resource sector.

His articles had been posted on over 400 sites, together with: Wall street Journal, Market Oracle, USAToday, country wide put up, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey analysis, 24hgold, Vancouver solar, CBSnews, SilverBearCafe, Infomine, Huffington post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/energy reviews, Calgary Herald, resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, fiscal sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

felony notice / Disclaimer: This document isn't and will now not be construed as an offer to sell or the solicitation of a proposal to purchase or subscribe for any funding. Richard Mills has based mostly this document on suggestions acquired from sources he believes to be professional however which has now not been independently demonstrated; Richard Mills makes no guarantee, illustration or guarantee and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are these of Richard Mills best and are area to exchange with out notice. Richard Mills assumes no warranty, liability or assure for the latest relevance, correctness or completeness of any assistance supplied inside this file and will not be held liable for the final result of reliance upon any opinion or statement contained herein or any omission. furthermore, I, Richard Mills, anticipate no liability for any direct or indirect loss or damage or, in certain, for misplaced profit, which you may additionally incur on account of the use and existence of the information supplied inside this report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE each day economic Markets analysis & Forecasting on-line booklet.

No comments:

Post a Comment